Make Your Credit Healthier And Begin Your Journey To Perfect Credit Today!

Sign up today for your personalized consultations!

Make Your Credit Healthier And Begin Your Journey To Perfect Credit Today!

Sign up today for your personalized consultations!

REPAIR YOUR CREDIT

Your credit doesn’t define you, but it can hold you back from achieving your dreams. With Capital B Unlimited, you can turn back time on your credit and finally move forward with your life.

An excellent credit rating is also one of the key building blocks in business. Whether you’re starting a new venture, seeking funding to support your business during a downturn, or planning expansion, our credit repair, and credit consultation services will help you identify critical issues, give you strategies to resolve them, and offer reliable avenues to funding your goals.

What Is Credit Repair?

Credit repair is the process of addressing and removing any negative items that are impacting your credit profile. Did you know that millions of Americans are victims of inaccurate or unfair negative items that wrongfully lower their scores?

Sign Up Through Our Portal

Sign Up through our portal. You’ll start by filling out a short form and creating a password to gain access to our secure portal.

Sign Up for Credit Monitoring

Our program requires you to signup with our preferred Credit Monitoring with Identity Theft Protection service.

Keep Up With Your Credit

Staying on top of your credit’s health is a great financial habit.

CREDIT REPAIR BENEFITS

Having bad credit can cost you a lot of time, energy, and money.

We'll help you repair your credit profile so that you can start reaping the benefits of having a good credit score and credit profile!

- SAVE TONS OF MONEY

Lenders use a risk-based pricing model that dictates the interest rates an individual is charged on a loan. Good credit means lower interest rates and little to $0 down payments. It also means no security deposits on things like utilities.

- HIGHER CREDIT CARD LIMITS

Your borrowing capacity is based on your income and your credit score. One of the benefits of having a good credit score is that banks are willing to let you borrow more money because you’ve demonstrated that you pay back what you borrow on time.

- BETTER INSURANCE RATES

Insurance companies use information from your credit report and insurance history to develop your insurance risk score, so they often penalize people who have low credit scores with higher insurance premiums.

- LIVE WHERE YOU WANT TO LIVE

More landlords are using credit scores as part of their tenant screening process. A bad credit score, mainly if it’s caused by a previous eviction or outstanding rental balance, can severely damage your chances of getting into an apartment. A good credit score saves you the time and hassle of finding a landlord that will approve renters with damaged credit.

- MORE NEGOTIATING POWER

A good credit score gives you leverage to negotiate a lower interest rate on a credit card or a new loan. If you need more bargaining power, you can take advantage of other attractive offers that you’ve received from other companies based on your credit score. However, if you have a low credit score, creditors are unlikely to budge on loan terms, and you won’t have other credit offers or options.

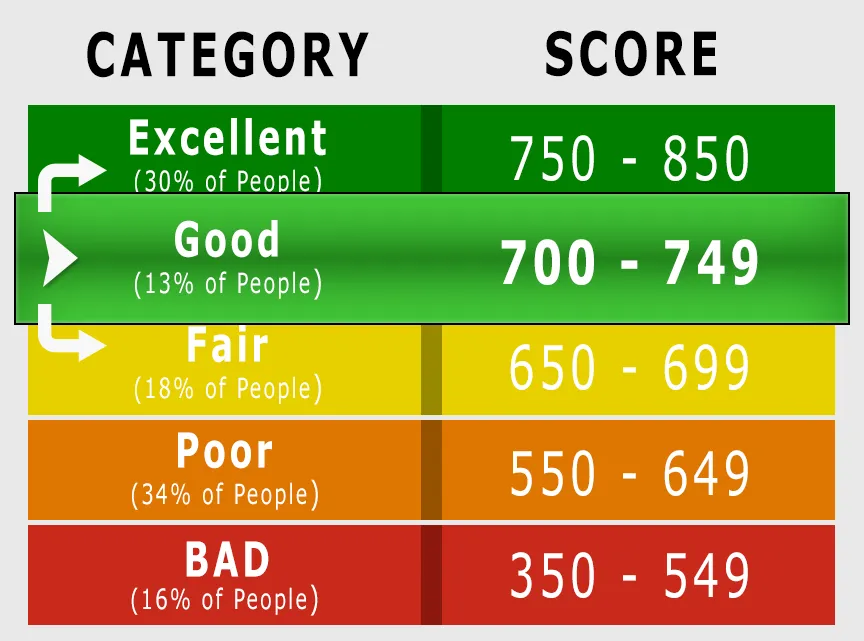

WHAT’S CONSIDERED A GOOD CREDIT SCORE?

As you can see from the scale, a good score is anything over 670. That means anything below 670 is not good. Let me repeat that: having a “fair” score is not good. Sure, fair is better than poor, but there’s a huge difference between a good and a fair score. We’re talking “get the home of your dreams” or “save thousands in interest rates” kind of difference. Even a few points could make or break your loan.

HOW DOES MY CREDIT REPORT AFFECT MY CREDIT SCORE?

Every item on your credit report is factored into your credit score. They’re 100% connected. That’s why with credit repair, we focus on making sure your reports are fair, accurate and substantiated, by challenging creditors and the bureaus to verify questionable items.

WE ALSO OFFER:

IT TAKES 3-21 days

WE ALSO OFFER:

IT TAKES 3-21 days

PRICING

SILVER

$99.99 to start

$99/ M

- Includes Correcting Personal Information

- Duplicates

- Shortfills Corrections

- Charge Off

- Foreclosure

- Medical Bills

GOLD

$149.99 to start

$99/ M

- Includes Correcting Personal Information

- Duplicates

- Shortfills Corrections

- Late Payments

- Charge Off

- Foreclosure

- Medical Bills

- Plus One Of These Following:

- Bankcruptcy, Judgement,

- Child Support, Identity Theft

PLATINUM

$199.99 to start

$99/ M

- Includes Correcting Personal Information

- Duplicates

- Shortfills Corrections

- Late Payments

- Charge Off

- Foreclosure

- Medical Bills

- Plus More Than One Of These Following:

- Bankcruptcy, Judgement,

- Child Support, Identity Theft

Say Goodbye To Your Bad Credit Score

We specialize in the full credit repair process. Our team of reputable, FICO-certified credit experts will work diligently on your behalf to delete any negative items from your credit report with all three credit bureaus (TransUnion, Equifax, and Experian), including:

- Collection Accounts

If you fall behind on payments, the lender or creditor may transfer your account to a collection agency or sell it to a debt buyer.

- Medical Bills

A single medical debt in collections can harm your credit score by as much as 100 points. And once the debt appears as unpaid on your credit report, it takes up to seven years to disappear.

- Tax Liens

Tax liens stopped reporting in 2018. However, some people may still find old tax liens reports on their credit profiles.

- Public Records

Anything that companies may consider a legal liability is a matter of public record. It will usually show up on your credit report.

- Repossession

Repossession has a severely negative impact on your credit and can show lenders that you may not be able to make payments on the property you purchase.

- Credit Inquiries

A credit inquiry occurs when you apply for a credit card or loan and permit the issuer or lender to check your credit. There are hard & soft inquiries.

- Bankruptcies

Bankruptcy is a legal proceeding involving a person or business that is unable to repay its outstanding debts.

- Child Support

Late or delinquent child support payments can be turned over to debt collectors or a collections agency, just like any other debt. The late payments will be recorded on your credit score.

- Inaccurate Information

Inaccurate or out-of-date information like your old addresses or employers could cause your loan/credit applications to get denied.

To keep connected please log in with your personal info and start your journey with us!

"Un-limit Yourself With Better Credit"

- Email: info@capitalbunlimited.com

1150 NW 72nd Ave Tower I STE 455 #5318, MIAMI, FL 33126

- (800) 413-8768

Personal and business funding options are available upon request

Tradelines are available upon request

Copyright @ Capital B Unlimited 2021. All Rights Reserved.